Over the previous week, the cryptocurrency sector achieved a serious milestone after the USA Senate handed the GENIUS Act. This landmark bill establishes the primary federal requirements for stablecoins, marking a major victory for the digital asset sector and presumably the Bitcoin market.

In response to this important breakthrough, US Secretary of the Treasury Scott Bessent highlighted that stablecoins may develop right into a $3.7 trillion business by the top of the last decade, particularly with the introduction of the GENIUS Act. “A thriving stablecoin ecosystem will drive demand from the non-public sector for US Treasuries, which again stablecoins,” Bessent mentioned.

In addition to the potential impression of a stablecoin market increase on the normal sectors, there may be additionally the numerous impact such an quantity of liquidity would have on the crypto market, particularly Bitcoin. A famend crypto journalist has come ahead with how the Bitcoin worth would react to a hovering stablecoin market worth.

May BTC Value Go On A Tremendous Rally?

In a June 20 publish on the X platform, crypto journalist Rafaela Romano shared an insightful evaluation of the Bitcoin worth efficiency in relation to a possible stablecoin market increase following current legislative breakthroughs. This evaluation relies on the “tremendous” relationship between liquidity in stablecoins and the worth of BTC.

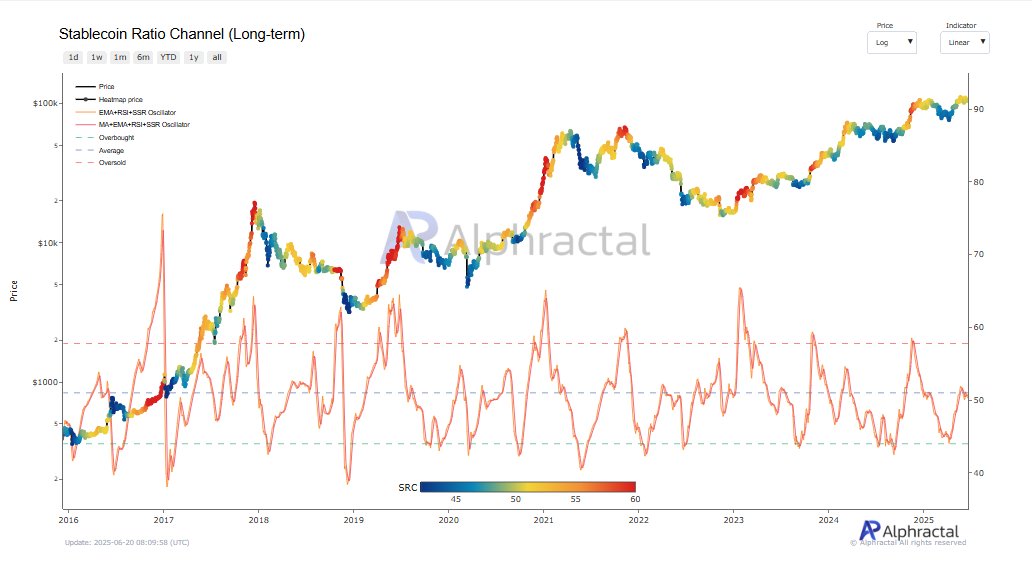

Within the publish on X, Romano highlighted the Stablecoin Ratio Channel (SRC) that signifies sustained bullish or bearish circumstances based mostly on adjustments in stablecoin provide. This metric means that shifts in stablecoin provide may precipitate important market motion over prolonged intervals.

The SRC (Lengthy-Time period) removes short-term noise by making use of a 90-day Relative Power Index (RSI) to the Stablecoin Provide Ratio (SSR) oscillator and smoothing it with a 7-day EMA. For context, SSR is calculated because the ratio between the Bitcoin provide and the availability of stablecoins.

Therefore, a falling SRC metric means that the stablecoin provide is rising quicker than the Bitcoin provide. As proven within the chart beneath, when the SRC reaches the inexperienced line, it signifies an oversold market situation for the premier cryptocurrency — a typical precedent for prolonged price rallies.

Supply: @hi_disruptivas on X

Therefore, if the stablecoin market capitalization sees a 15x development over the approaching years, it implies that the worth of the SRC would seemingly plummet beneath the inexperienced line. In the end, Romano believes that this might imply a “tremendous a number of” for the price of Bitcoin.

Bitcoin Value At A Look

As of this writing, the worth of BTC stands at round $103,550, reflecting an virtually 1% decline prior to now 24 hours.

The value of BTC on the every day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our group of high know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.