Ethereum has spent a lot of December beneath strain, and the recent fall below $3,000 has left a visual mark on investor positioning.

On-chain information now exhibits a notable deterioration in profitability throughout the community, with the share of ETH provide sitting in revenue falling under 60%. On the identical time, institutional demand has decreased, with information from Glassnode displaying how each retail profitability and institutional participation in Ethereum have weakened concurrently.

Associated Studying

Ethereum’s % Provide In Revenue Falls Beneath 60%

The drop in Ethereum’s p.c provide in revenue has been one of many clearest signals of stress for Ethereum. Ethereum’s traders have fallen into deeper losses, and this can be a reflection of current value motion.

Talking of value motion, Ethereum had initially reclaimed the $3,000 value stage on December 22. Throughout this time, the share of ETH provide in revenue pushed again above 60% and reached as excessive as 63%. Nonetheless, this break was for less than a really temporary time, and value motion fell again under $3,000 after only a few hours.

As ETH broke under $3,000 once more, the share of provide held at unrealized positive factors fell beneath 60%, down from above 70% earlier in December. This fall exhibits that the pullback has not been restricted to current consumers however has begun to affect traders who accrued through the starting of the month.

ETH Percent Supply In Profit. Source: Glassnode

ETF Web Outflows Point out Waning Institutional Participation

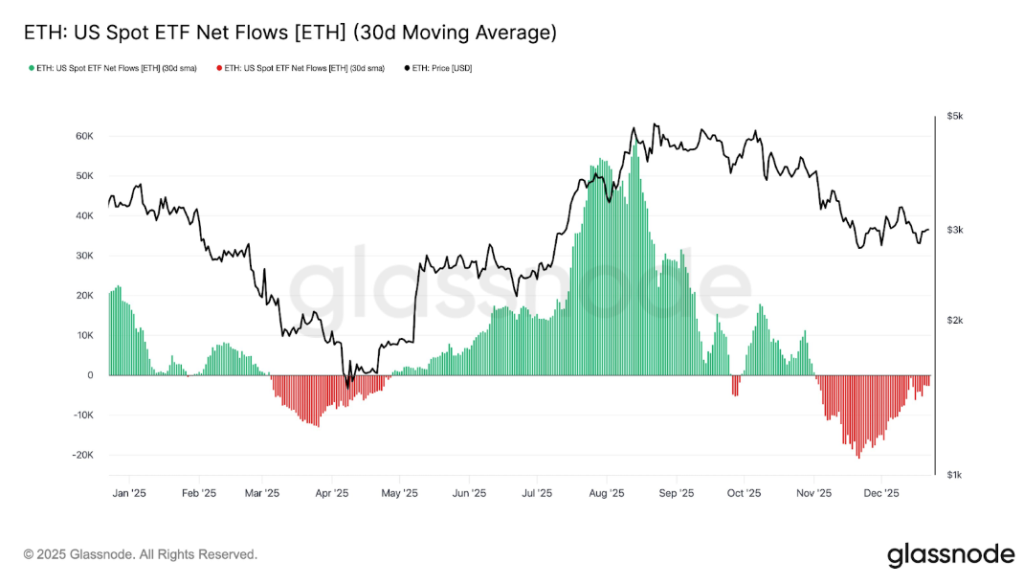

The weak point in on-chain profitability and value motion can be a mirrored image of developments within the ETF market. One other information metric from Glassnode shows that since early November, the 30-day shifting common of web flows into US Spot Ethereum ETFs has turned detrimental and remained there. This persistence of outflows factors to a section of muted participation and disengagement from institutional merchants.

The ETF chart under exhibits that inflows, which supported Ethereum’s push to new all-time highs in August, have pale, replaced by continued outflows by way of November and December. This issues for value motion as a result of ETF demand has been a key supply of incremental shopping for. As that bid has weakened, Ethereum has struggled to soak up sell-side strain, contributing to its failure to carry above $3,000.

ETH: US Spot ETF Net Flows. Source: Glassnode

The mixture of detrimental ETF web flows and Ethereum’s current value behaviorhelps clarify rising unrealized losses. Curiously, various on-chain data sources additionally reveal completely different cases of whale addresses lowering their publicity to Ethereum outdoors of spot ETFs.

As an example, Lookonchain lately highlighted activity from a wallet believed to be linked to Erik Voorhees, which swapped 4,619 ETH, valued at about $13.42 million, into Bitcoin Money (BCH) over the previous two weeks after having been inactive for almost 9 years. Voorhees later responded by clarifying that the pockets doesn’t belong to him and that he doesn’t maintain any Bitcoin Money.

Associated Studying

Lookonchain additionally pointed to selling pressure from Arthur Hayes, co-founder of BitMEX, who has offloaded a complete of 1,871 ETH at about $5.53 million prior to now week.

Featured picture from Unsplash, chart from TradingView