Bitcoin is struggling to carry above the $95,000 stage as concern spreads throughout the market, with merchants unsure whether or not the current correction marks the start of a broader downtrend or only a non permanent shakeout. The main cryptocurrency has been below sustained promoting strain, wiping out months of bullish momentum and pushing sentiment towards excessive warning.

Analysts stay divided on the subsequent transfer. Some argue that Bitcoin could possibly be getting into the early phases of a bear market, pointing to weakening momentum and rising short-term losses amongst holders. Others, nevertheless, imagine that this consolidation part is setting the stage for a serious restoration, with potential for a surge past all-time highs as soon as market sentiment stabilizes.

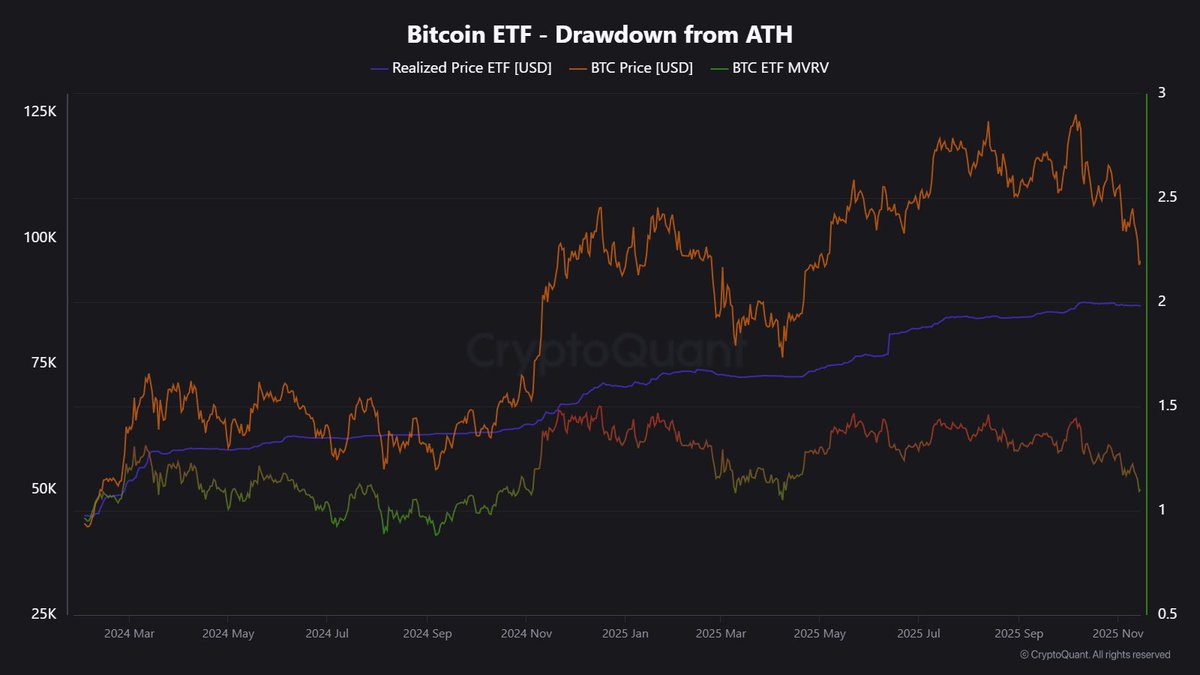

Regardless of the volatility, on-chain knowledge affords a glimmer of strength. Bitcoin remains to be buying and selling above the ETF Realized Worth, in line with CryptoQuant. Which means, on common, ETF buyers stay in revenue — an indication that institutional demand stays resilient even amid retail concern.

ETF Buyers Stay in Revenue Regardless of Market Concern

In keeping with prime analyst Maartunn, Bitcoin’s ETF Realized Price — the typical price foundation of all spot Bitcoin ETF holders — at the moment stands at $86,680. Regardless of the current wave of volatility and fear-driven promoting, Bitcoin remains to be buying and selling roughly 9% above this important stage, suggesting that the majority ETF buyers stay in revenue.

This metric serves as an essential gauge of institutional sentiment. The truth that Bitcoin continues to commerce above ETF buyers’ price foundation signifies that institutional demand stays resilient, whilst retail sentiment turns bearish. Traditionally, when Bitcoin holds above key realized value ranges throughout corrections, it alerts underlying energy and reduces the chance of a protracted bear part.

Furthermore, ETF inflows have remained steady, exhibiting that long-term holders aren’t panic-selling regardless of value weak spot. These buyers are inclined to view market dips as alternatives to build up quite than liquidate positions — a stark distinction to short-term merchants who typically react emotionally to volatility.

If Bitcoin can maintain its place above the ETF Realized Worth, it might reinforce this structural assist and will function the launchpad for a restoration as soon as broader market sentiment shifts from concern to cautious optimism.

Bitcoin Finds Help Amid Heightened Market Concern

The weekly Bitcoin chart reveals the cryptocurrency hovering simply above $95,000, making an attempt to stabilize after weeks of constant promoting strain. This marks the primary time since Might that BTC has revisited this zone, which now acts as a vital assist stage each technically and psychologically. The decline from the current highs close to $120,000 has been sharp, reflecting a shift in sentiment as concern and uncertainty dominate the market.

The 50-week shifting common at the moment sits close to $94,000, and Bitcoin’s means to stay above it may outline the subsequent market part. Traditionally, this shifting common has been a dependable assist line throughout mid-cycle corrections, typically signaling accumulation zones quite than the beginning of extended bear markets. In the meantime, the 200-week shifting common — a long-term structural flooring — stays far beneath close to $70,000, highlighting that Bitcoin’s macro pattern stays intact.

Quantity knowledge additionally suggests a possible capitulation part, with current promote strain accompanied by rising buying and selling exercise, indicating stronger palms could also be absorbing weak provide. If Bitcoin holds this vary, a rebound towards $100,000–$105,000 may comply with. Nevertheless, shedding $95K would expose the market to additional draw back, probably testing decrease helps earlier than stability returns.

Featured picture from ChatGPT, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our workforce of prime know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.