After a robust breakout final week that pushed Bitcoin into a new all-time high of $118,667, the world’s main cryptocurrency seems to be taking a breather. As of the time of writing, Bitcoin is buying and selling round $117,953, barely under its current peak. The transfer adopted a string of consecutive every day positive factors as bullish momentum swept throughout the crypto trade.

In a technical evaluation shared on the TradingView platform, crypto analyst RLinda identified two eventualities which will play out over the approaching days and weeks, relying on how Bitcoin reacts to close by resistance and assist ranges.

Associated Studying

Assist Zones Might Have an effect on Bitcoin’s Subsequent Huge Transfer

RLinda’s technical analysis begins with figuring out the importance of Bitcoin’s current all-time excessive. Though Bitcoin has entered what appears to be a consolidation part, there’s no confirmed high simply but. The market construction still favors bullish continuation, particularly contemplating Bitcoin is simply popping out of a protracted two-month consolidation zone and getting into a realization part.

In line with the 1-hour candlestick value chart, Bitcoin is at the moment buying and selling simply above a assist space under $117,500. If Bitcoin fails to carry this zone, the main cryptocurrency might kick off a cascade of corrections that could drive the worth to $115,500, then doubtlessly to $114,300, and even again to the earlier all-time excessive of $111,800.

Beneath that, the 0.5 and 0.705 Fibonacci ranges round $113,031 and $111,960 respectively could act as short-term cushions. The final main defensive purchase zone is round $110,400, the place bulls could step in for a bounce. Principally, what this implies is that if Bitcoin loses the assist degree at $115,500, it might slip again to $110,000 earlier than encountering one other robust purchase assist zone.

Image From TradingView: RLinda

Bitcoin To $125K, However It Should Breach Resistance First

Alternatively, Bitcoin can nonetheless push above $118,000 and enhance to $125,000, however solely beneath sure circumstances. The situation of the rally’s continuation relies upon totally on Bitcoin registering a decisive every day shut above $118,400 and $118,900. In her phrases, a every day shut above these value ranges would trace at a “breakout of construction.” This, in flip, would verify a transition from consolidation into another impulsive phase upward.

In essence, both the bearish and bullish outlooks rely on how Bitcoin reacts at any of the vital zones, both assist at $116,700 or resistance above $118,400 earlier than making a directional transfer. Nevertheless, you will need to observe that the consolidation after final week’s rally might final for weeks and even months, very like we’ve seen in earlier rallies this cycle.

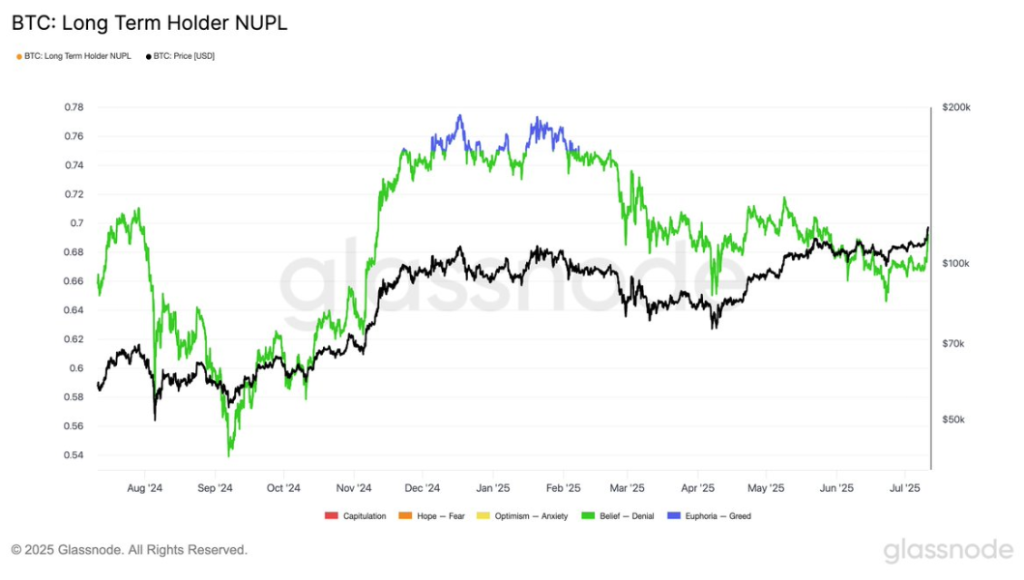

In line with the Lengthy-Time period Holder Web Unrealized Revenue and Loss (NUPL) metric from Glassnode, Bitcoin’s present degree of long-term profitability sentiment is at 0.69. That is notably under the 0.75 mark related to euphoric market circumstances, regardless of Bitcoin having simply printed a brand new all-time excessive.

Associated Studying

Bitcoin spent round 228 days above the 0.75 euphoria threshold within the earlier bull market cycle. In distinction, this present cycle has solely seen about 30 days above that degree, which suggests long-term holders haven’t but totally exited into revenue and the main cryptocurrency hasn’t reached overheated circumstances.

Featured picture from Unsplash, chart from TradingView